Benefits of a Family Trust

What is a Trust?

You have probably heard terms like family trust and unit trusts in the context of investments. But what are they?

Parties involved in a Trust

Settlor

A settlor is usually an unrelated party to the beneficiary (such as your financial adviser or accountant). They give the property to the trust in the form of a gift or a settlement, usually, a nominal sum of $10, to set up the trust. A settlor’s role ceases after that point.

Trustee

The trustee is responsible for managing the trust’s tax affairs, including registering the trust in the tax system, lodging trust tax returns and paying some tax liabilities.

Appointor

An appointor appoints or removes trustees from a trust. They do not have any ongoing control of the trust but have the final control in terms of the trustees’ appointment or removal.

Beneficiaries

People or entities entitled to the ultimate benefits of the trust, such as income and capital from the trust’s assets. For example, parents as trustees of the trust would have their children as the beneficiaries to pass on wealth in a tax-effective manner. Any income distributed to the beneficiaries is included in their personal taxable income. A beneficiary can be an individual or a company (with any distributions to a company being taxed at the company tax rate).

Types of Trusts

Special Disability Trust

Each type of trust serves a different purpose. So, it is important to work with a professional like a financial adviser who can assess your situation and help select the appropriate trust type for you.

In this article, we will focus solely on Discretionary Family Trusts

What is a Discretionary Family Trust?

A family trust is a type of discretionary trust that is set up to control and protect family assets. It also serves as an essential structure for the intergenerational transfer of wealth.

Within a family trust, you can buy assets such as shares, managed funds, investment property, art, collectibles and any other legal asset.

Importance of a family trust’s income distribution

As it is a discretionary trust, the trust’s income distribution is not fixed, allowing the trustees to distribute at their discretion. This provides the flexibility of income distributions which is a key benefit of this structure. However, if done incorrectly, it can lead to unwanted tax consequences.

A distribution creates an entitlement between the Trust and the beneficiary. Cashing out the income is one form of proving that the distribution was paid to the beneficiaries. However, some trusts reinvest the income, which allows beneficiaries’ balances to flourish. A beneficiary can however call upon the trustee to cash out the distribution as required.

Pros

Tax minimisation

Trustees can distribute income to beneficiaries at their discretion. Given the trust income is taxable individually and not to the trust, trustees can effectively utilise every beneficiary’s tax-free threshold and distribute income to as many beneficiaries as possible.

Also, if you own a family business, you can have a family trust in place with a company acting as trustee (a corporate trustee). This way, you can retain a company structure’s limited liability benefits and also access the tax advantage of a family trust. You can tax effectively distribute business profit to family members with lower marginal tax rates or utilise each family member’s “tax-free thresholds”.

Asset Protection

If a trust owns property within it, the property is not exposed to any bankruptcy or creditors claim that a beneficiary may face personally. The property remains protected within the trust.

Also, as the trustees have the right to add or remove beneficiaries, the trust remains a close-knit entity. This adds an extra layer of protection to a claim by an estranged family member, former spouses, or stepchildren.

Estate Planning

Usually, a family trust deed is flexible in terms of its functioning, thereby allowing for estate management strategies. It allows different generations of a family to benefit from an asset without needing to transfer ownership.

For example, if the trust holds a family’s business commercial property within it, it can be passed on from one generation to another by updating the trust’s beneficiaries, thus avoiding the need to transfer assets in the personal name, which can incur additional costs.

Lenient rules compared to super

Holding assets within a family trust is easier and simpler than owning them within the super environment. Super is bound by strict rules in terms of the types of assets and the need for non-arm’s length investment transactions. However, a family trust is mainly used for arm’s length purposes to protect assets within a family.

Cons

Cost

Setting up and managing a trust requires time and assistance from professionals. This involves additional administration, which in turn incurs costs. This is why involving a financial adviser, an accountant, and a solicitor is important to consider whether a family trust is the right set-up for you.

Family affair

As a family trust involves family members dealing with the family’s finances, it can cause internal conflicts at times. Family conflicts, changes to Wills, death, relationship breakdown and other such instances can lead to ramifications on the trust’s control.

Tax Impact

Any trust income not distributed to the beneficiaries each year is taxed at the top marginal tax rate. This means that it is generally not a tax-effective vehicle to accumulate money. Distributions to minor children can be taxed up to 66%. While there can be tax benefits using a trust, it depends on how you’re using it.

If the trust incurs any tax losses, they cannot be passed on to the beneficiaries personally and should remain within the trust. However, tax losses can be carried forward to offset any future earnings of the trust.

Example 1 – No other family member to distribute income to

Facts of the case

-

Tim and Jen were in their early 30s when they set up a family trust called T & J Family Trust to buy investment properties.

-

They are the trustees and the beneficiaries of the trust.

-

Over the next ten years, they have bought three investment properties that are positively geared.

-

They each are currently earning $150,000 p.a. with a marginal tax rate of 37%.

-

They do not have any children, and their parents have passed away.

-

They have decided to sell their first investment property, ten years after they first bought it. The estimated capital gain after discount is $100,000

-

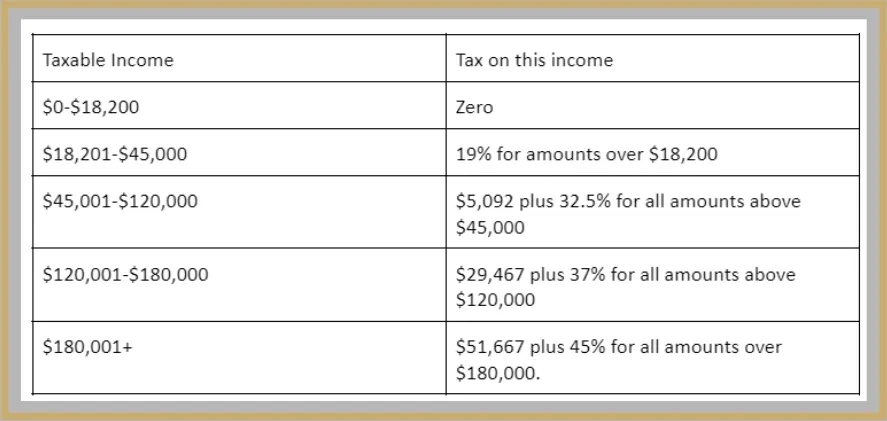

Australian resident tax rates 2021-2022:

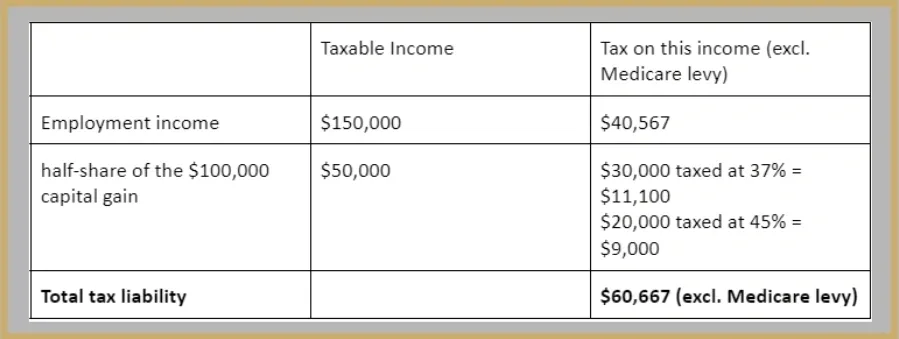

Income Distribution

When their total income (employment and trust distributions) was below $120,000 p.a., they were taxed at 32.5% plus Medicare levy. After their employment income went above $120,000 p.a., their trust income was taxed at 37% plus Medicare levy.

They did not have any family members to pass on the income to, so they were forced to pay income tax at this higher tax rate. Had they had adult family members to distribute the income to, they could have distributed the capital gain to these members to keep their own marginal tax rates at 37%. Depending on the marginal tax rates of the members of their family, they could have saved a significant amount of tax on the distribution.

Example 2 – Family members to distribute income to

Facts of the case

-

Tim and Jen were in their early 30s when they set up a family trust called T & J Family Trust to buy investment properties.

-

Tim and Jen are the trustees of the trust.

-

Over the next ten years, they have bought three investment properties that are positively geared.

-

They both are currently earning $150,000 p.a.

-

They have a 10-year-old daughter.

-

Jen’s parents, Roger and Mary, are in their 70s and are self-funded retirees with no Centrelink income.

-

Tim, Jen, Roger and Mary are the beneficiaries of the trust.

-

They have decided to sell their first investment property, ten years after they first bought it. The estimated capital gain after discount is $100,000.

-

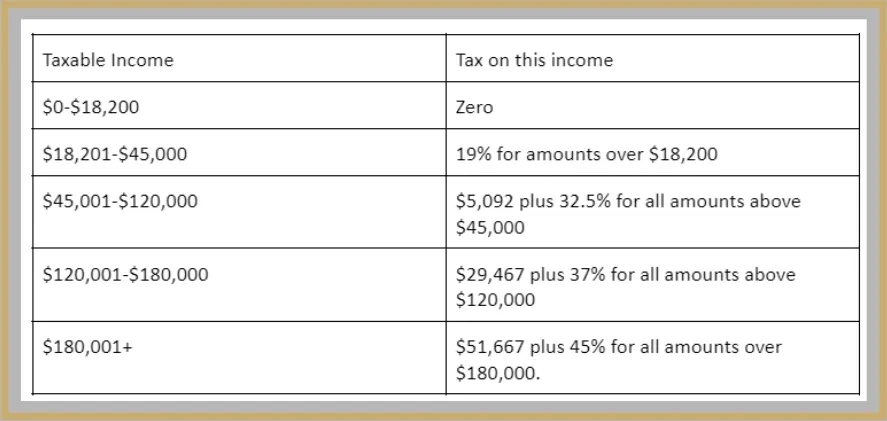

Australian resident tax rates 2021-2022:

Income Distribution

In this case, as Tim and Jen have two other family members to pass on the income to, they could tax effectively distribute the trust income amongst all 4 of them.

Over the past ten years, since Tim & Jen wanted to earn income from the trust, they first distributed income to themselves when their salary and trust income was taxed up to the 32.5% plus Medicare levy rate. They then distributed the rest of the income to Roger and Mary as they had nil taxable income.

After their employment income went above $120,000 p.a., all the trust income was distributed to Roger and Mary.

When they sold the first investment property, the $100,000 discounted capital gain meant that Roger and Mary’s taxable income brought their marginal tax rate to 32.5% plus Medicare levy. However, that is still lower than Tim & Jen’s tax rate.

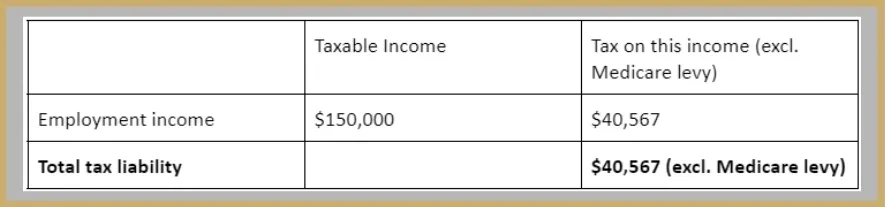

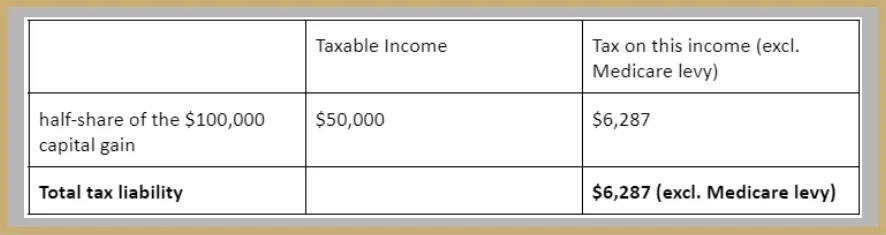

The following tables show the tax liability breakdown of all four beneficiaries. Tim and Jen each have a tax liability of $40,567, while Roger and Mary must each pay $6,287. This amounts to a total tax of $93,708 on their combined $400,000 of income. By having additional beneficiaries to distribute the funds, they reduced their tax liability by $27,626.

The tax liability break down for each member is as follows:

Tim and Jen

Roger and Mary

Based on current rules, they did not distribute income to their daughter as she is still a minor child and would have been taxed 66% if more than $416 was distributed to her.

If they had an enormous capital gain of, say, $300,000, the above options might be deemed uneconomical. In that case, a bucket company could be set up as a beneficiary to receive the income as it would be charged between 25% to 30%. However, this is a complicated area, and you should consult your financial adviser and accountant to explore this strategy.

As you can see, a family trust can have various benefits in terms of protecting assets and tax minimisation. However, it is important to consider the risks associated with it. It is important to seek personal financial advice from a financial adviser to help guide you through this process.