Investing might not be the first thing that comes to mind when thinking about childhood memories. However, for many of us, the journey into the world of investments began in our early years, thanks to the unintentional efforts of our parents.

As a child, I vividly recall the excitement of opening cheque envelopes, revealing dividends from my dad’s stock investments. Even at the age of five, I questioned the seemingly small amounts. Patiently, my dad explained that someone was paying him for the money he had shared—an early and profound introduction to the concept of returns.

My mum contributed to this indirect investment education by engaging in a practice similar to olden-day derivative trading—buying and storing grains for future use or sale. This simple yet effective strategy introduced me to basic financial concepts that have lasted a lifetime.

For Australian parents looking to teach their kids about investing, consider adopting the “10 for 10” concept. Starting from the age of five, encourage your kids to save 10% of the money given to them over a year, promising them an additional 10% as a reward. This straightforward approach not only introduces the concept of percentages but also instills valuable lessons about saving, patience, and financial responsibility.

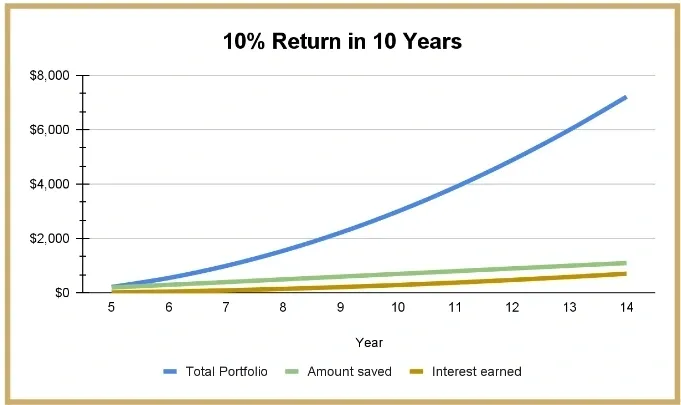

Let’s consider a scenario: A 5-year-old kid receives a total of $1,000 from gifts and saves $100 of this. Promising them 10% more at the end of the year means they get $110 for the first year. If this continues for 10 years, with the amount growing by an additional $1,000 every year, the child would have accumulated savings of $7,209.

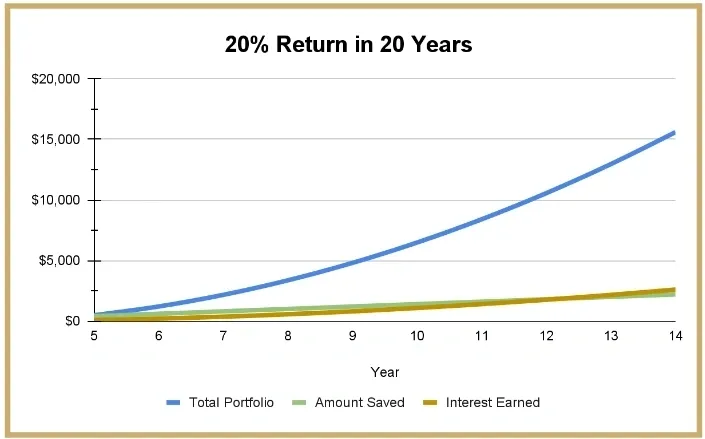

Behaviour trumps the amount, setting kids up for long-term success. Parents can also consider the “20 for 20” concept, giving more rewards for greater savings. This not only keeps the kids disciplined but also helps them understand the principles of investing.

Consider using digital piggy banks for easier tracking. This can be integrated into special occasions, like Christmas, where your kids present their piggy banks for rewards and perhaps minimal deductions for spending. The impact of this practice goes beyond just financial literacy:

- Engages kids actively in the process

- Teaches practical math skills

- Encourages responsible safekeeping of their money

- Fosters a sense of responsibility, making them feel more like adults

- Instills patience and the importance of saving

As you cultivate these habits early on, your kids will develop a natural affinity for investing and financial management. The lessons they learn now will shape their confidence and understanding of investment even before they hit their first decade.

Remember, start early, and watch as your kids grow into financially savvy individuals.