It is much easier and more enjoyable to take the income, the money we have earned and worked hard to receive and spend all of it every month — purchasing whatever we want and not thinking about the future. There are so many reasons to save for the future and this is not necessarily just for retirement. Saving means allowing a break from the pay cheque to pay cheque cycle or allowing for a big purchase down the road, like a vehicle, vacation, or house. Living from month-to-month, surprisingly, is not just something that happens to those earning lower incomes, but to anyone unable to create a budget and follow it, in addition to making savings goals and reaching them.

Between today and the conclusion of our income-earning days, a lot can and will happen. We might lose our job, take a pay increase or decrease, move, or become unable to work. Strategising about the income we make now and the importance of devising plans for the future is one of the best things we can do with our hard-earned money.

According to Finder’s Consumer Sentiment Tracker, the total value of all savings accounts in Australia is an estimated $565 billion, with the average person having $29,091 saved. Understandably, households earning more than $100,000 per year have around three times as much money saved as households earning less than $50,000. And as the generation that’s worked the longest, baby boomers have the most in savings ($41,988), while gen Z have the least ($10,990).

Men have considerably more money saved up than women. While the average man has $37,380 stockpiled, the average woman has just $21,061 in savings.

Interestingly, the discrepancy between male and female savings is greatest among generation Z Australians, with men having 117% more in savings than women. This is followed by baby boomers, where the difference is 59%.

Average Savings (Whole Australia)

Men: $37,380

Women: $21,061

Baby boomers: $41,988

Gen X: $34,124

Gen Y: $23,371

Gen Z: $10,990

KEY TAKEAWAYS

-

Saving sufficiently for the future — defined as either tomorrow or three decades from now — is crucial.

-

Key steps for saving include making a budget (with a live-in partner if you have one), reviewing your expenses, and understanding your household’s cash flow.

-

Other key steps include automating your savings, looking for ways to economise by distinguishing between wants and needs.

-

Do remember to build in the occasional splurge. This splurge can be up to 15% of your budget, read our Path to Financial Independency blog for more tips and guidance on this and other aspects.

-

The best time to start saving is right now.

SPECIFIC STEPS FOR SAVING

Once you realise the importance of saving and the role that it plays in your life, creating specific saving goals is the next step to stay on track. Part of setting financial goals is making sure you can meet them. Don’t set unrealistic savings goals, for example – if you have never saved before and would like to, it is unrealistic to think you can start saving 10% of your take home straight away. You would have to start smaller and build it over time.

Armed with the education and tools to create realistic goals for your money, it is time to find and dedicate the money to reach your goals. Follow this systematic process to start saving.

1. Set a Emotive and Smart Savings Goal

This is crucial because we all need good reasons to stick to a plan. SMART is self explanatory but the emotive needs to be something that triggers a strong response.

A SMART goal is – ‘I want to save $100,000 in 2 years for my house deposit.’

A SMART and emotive goal is – ‘I want to save a deposit of $100,000 in 2 years for a place I can call home, have a family and build memories as they grow up. I want this for myself and family because I did not have this growing up and would love to share this place with my family and friends.’

Your emotional goals will help stay on course in tough times.

2. Review Your Current Accounts

Sometimes we do not even realise what we are spending each month until we examine it. Review everything you pay for. This is when you go through the last quarter of your expenses examining spending patterns and your balance sheet. This will allow you to take stock of your expenses in a manageable and achievable manner.

3. Work with Your Partner

If you have a partner or share bills with someone, communication and teamwork concerning your household finances are crucial. To save, you both need to be on board with your desires, plans, and resources. The best-laid plans without everyone on board will meet turmoil. It is important to do this after you have reviewed your expenses because it is a lot stronger to go to your partner with some work done towards the plan in case they are not good at this as well. It shows them you both can save and you are serious about this. Encourage them to add their own emotive reasons to step 1 if it is a joint goal.

4. Distinguish Between a ‘Want’ and ‘Need’

Understand the differences between needs and wants and identify yours. Be able to say no when something does not align with your financial goals, today and in the future.

5. Look for Places to Cut

What expenses or items can you cut to enhance your savings goals? There are five key areas to review for opportunities, including rent or mortgage – usually the bigger items. Do you need a 2 bedroom apartment and do you need to live in an expensive suburb? Take stock of energy and utility bills, food and grocery expenses, banking and credit card fees, taxes, and auto expenses, such as petrol or insurance.

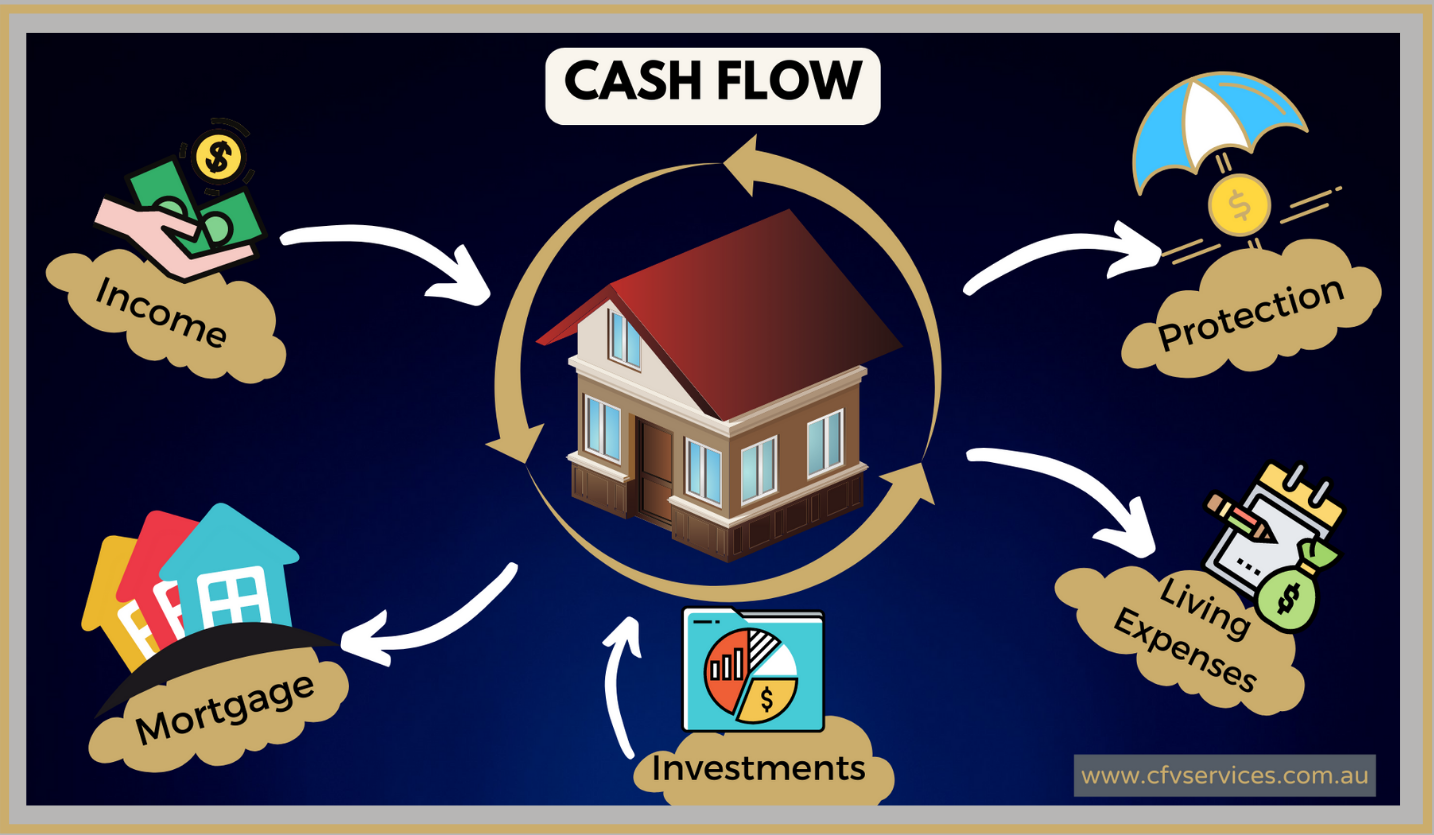

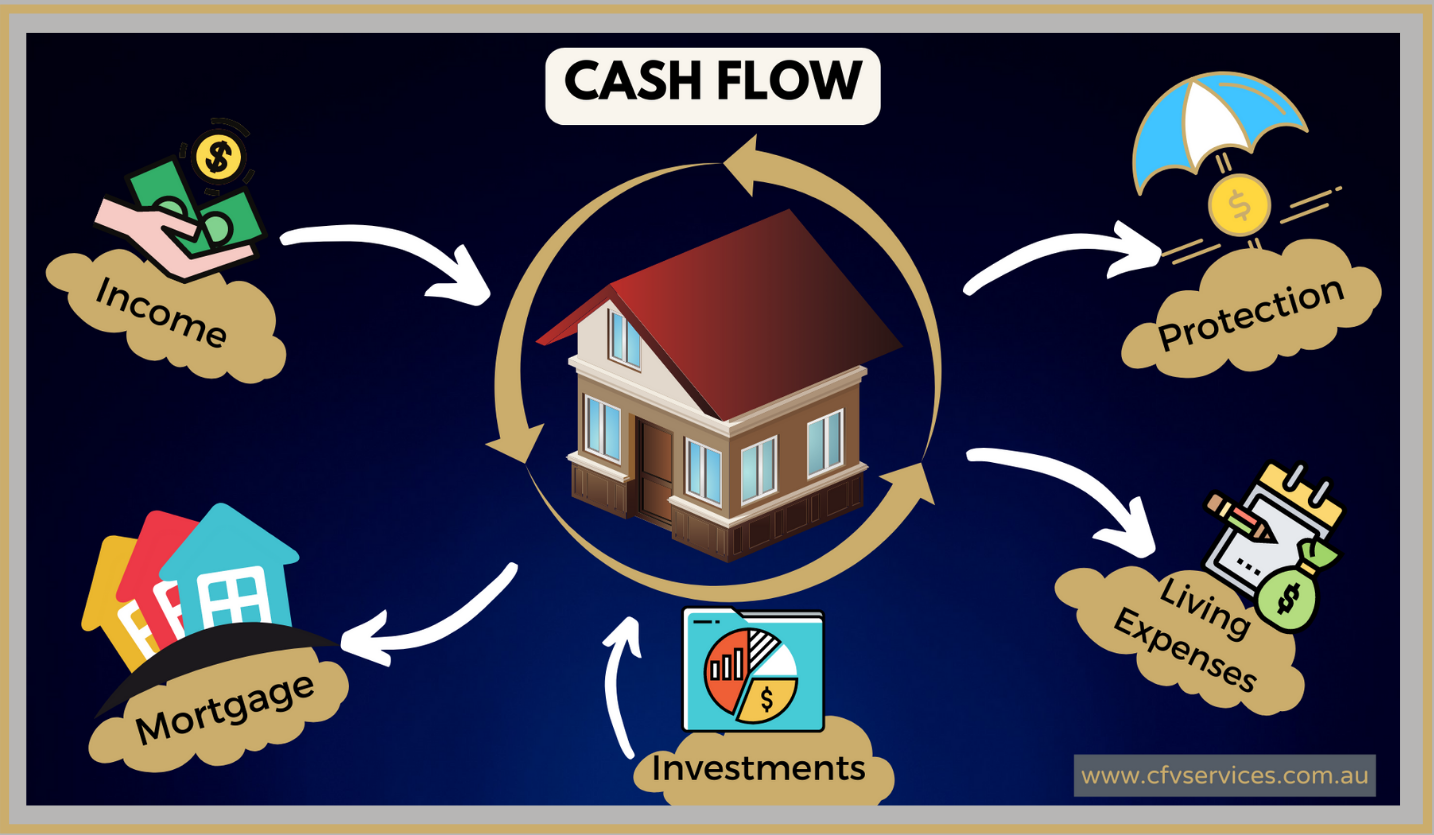

6. Understand the Concept of Cash Flow

You need to understand cash flow – what it is, how it works, and what your personal household outgoings looks like. Anticipated incoming money is not part of the cash flow process until you receive the funds. Don’t get into the habit of spending future money, wait until you receive the funds. Review your income and expenses and see where your spending habits lay. Be intentional about making smart changes and cutbacks in your spending.

7. Make a Budget

Now you need to make a budget and stick to it. This includes being realistic about your household financial situation and setting honest and attainable numbers corresponding to your spending so that you can save. Saying you will save and thinking about saving is not enough. You will have to be intentional about what you do with your money.

8. Make It Automatic

Automate savings so the money stays. If you wait until the end of the month to save, the likelihood will be that there is not much left to save. Make it automatic and have money transferred straight out of your bank account on pay day, or have a portion go into a savings account straight from and by your employer. Opening a bank account specifically for saving is a strategic way to consolidate your money while avoiding the temptation of having your funds too accessible. When you see your savings grow, you are more likely to keep it there.

9. Think about your Family and Possibilities

It is incredibly important to become a role model when it comes to savings and spending. It is also crucial to set an example: Your children mirror your behaviours and will take your lead on the role of money in their lives. Some essential lessons include waiting to purchase something you want, saving, identifying specific ways for children to save (such as using jars or envelopes), making wise choices, and understanding saving goals and discipline.

10. Start Now

Remember that whatever your goal is, start now. Something will always come up and compete for your resources. Saving for the future should stay in the forefront of your mind, and your finances, regardless of whatever else comes around.

11. Enjoy Life

Yes, we have been preaching the virtues of discipline, belt-tightening, and resisting instant gratification. However, recognising the importance of saving does not mean you cannot now and again spend on things for fun, relaxation or celebrations. The above strategies will help you to be committed to a budget while saving for your short-term and ideally long-term investment strategies.